jones county tax assessor texas

2021 Notice of Tax Rates Notice. Order Continuing State of Disaster Coronavirus 31st Amendment - March 28 2022.

Election Staff Abruptly Quits Upending Rural Texas County Honolulu Star Advertiser

Our next delinquent tax sale is scheduled for November 01 2022.

. Order Continuing State of Disaster Coronavirus 31st Amendment - March 28 2022. Box 511 Anson TX 79501 Phone. TaxNetUSA members with a Jones County TX Pro subscription.

Property GIS Maps are displayed on property detail pages in Jones County TX for all registered members where available. Welcome to Jones County Texas. County Tax Assessor-Collector.

Ad Reduce property taxes for yourself or others as a legitimate home business. Declaration of Disaster - Wildfires - March 28 2022. Ad Look Here For Jones County Property Records - Results In Minutes.

The Polk County Tax Office is responsible for the collection of taxes for the following taxing entities. Reduce property taxes for yourself or residential commercial businesses for commissions. Jones County Assessors Office Jones Texas - Address Phone Number Fax Website and Public Records.

Jones County Tax Assessor- Collector Ellisville Courthouse 101 North Court Street Suite A Ellisville MS 39437. 2022 Mobile Home bills were mailed January 31 2022 and were due Friday April 01. 2022 Notice of Budget Hearing.

Applicatiion deadline is February 18 2022. Order Adopting 2021 Tax Rates. Box 552 Anson TX 79501 Phone.

Jones County Assessors Office Contact Information. Address Phone Number and Fax Number for Jones County Assessors Office an Assessor Office at Courthouse Square. Find property records tax records assets values and more.

Ad Online access to property records of all states in the US. Remember to have your propertys Tax ID Number or Parcel Number available when you call. See the full list of unpaid taxes HERE.

Notice of 2022 tax rate vote. Declaration of Disaster - Wildfires - March 28 2022. Our goal is to provide.

The median property tax also known as real estate tax in Jones County is 73000 per year based on a median home value of 5170000 and a median effective property tax rate of. Search parcel information using Owner Address or Property ID. 2021 Notice of vote on Tax Rate.

You can call the Jones County Tax Assessors Office for assistance at 325-823-2437. Search Jones County Records Online - Results In Minutes. The Assessors Office establishes Tax Assessment values only.

2022 Notice of Tax Rates. The Jones County Tax Commissioners Office should be contacted at 478-986-6538 with tax bill and motor vehicle. Phone 601- 426 3248 Fax 601- 428.

Welcome to Jones County Texas.

Bandera County Courthouse Bandera Texas Photograph Page 4

Jones County Appraisal District

3551 East Tremont Ave Bronx Ny 10465 Tremont Bronx Property Records

Get Real Estate Comparables That Show The True Market Value Of The Property Real Estate Fun Ohio Real Estate Real Estate Memes

1925 E Belt Line Road Carrollton Tx 75006 Carrollton Photo View Photos

/cloudfront-us-east-1.images.arcpublishing.com/dmn/JQTHGBWA2ZDVHLERW44X3JHWKA.JPG)

She Died Of Sadness Plus Equifax Failures Denton County Dysfunction And Spam Calls

Ann Harris Bennett Harris County Tax Assessor Collector Politician

Frank Teich Frontier Texas Sculptor Sculptor Monument Sculpture

Tac Tax Assessor Collectors Association

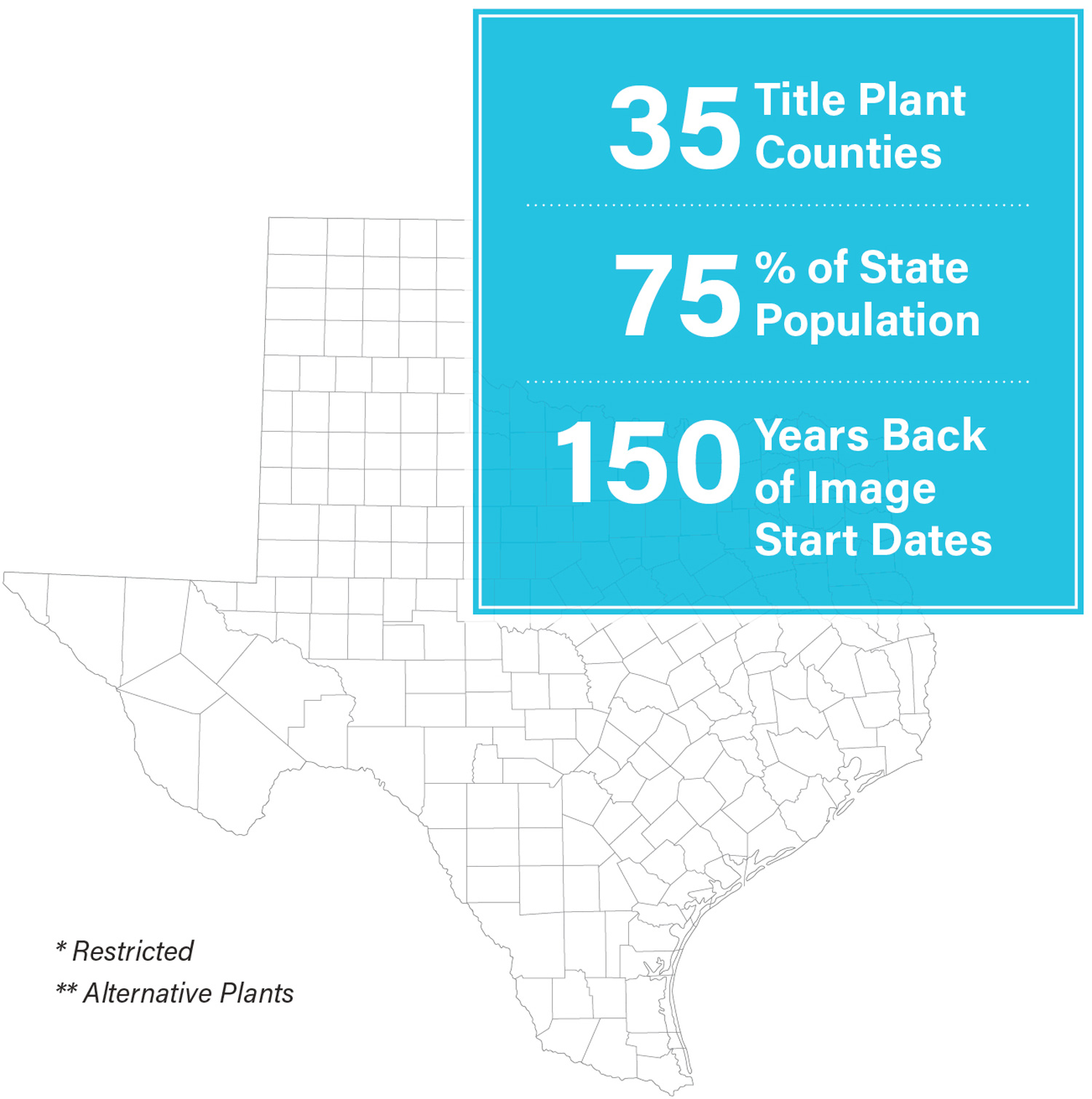

Texas Tax Certificates Title Plants From Data Trace

Jones County Appraisal District

Ann Harris Bennett Harris County Tax Assessor Collector Politician

Breaking It Down This Is How The New Texas Property Tax Law Affects You